Digging into Crude Oil, Gasoline and Natural Gas Prices 3.0

Dean Foreman

Posted March 10, 2022

Since last month’s “Digging into Crude Oil Prices 2.0” post, Russia’s war on Ukraine has reverberated through global markets that were already tight, helping spike oil prices to more than $130 per barrel – their highest since July 2008. In fact, since Russian invaded Ukraine global oil prices rose by more than $37 per barrel within two weeks ended March 8, their largest two-week price increase on record since 1990, perhaps anticipating the Biden administration would announce plans to ban U.S. imports of Russian energy.

Let’s grapple with some of the latest questions pertaining to this very dynamic situation.

How might the proposed U.S. ban on imported Russian oil affect U.S. gasoline costs?

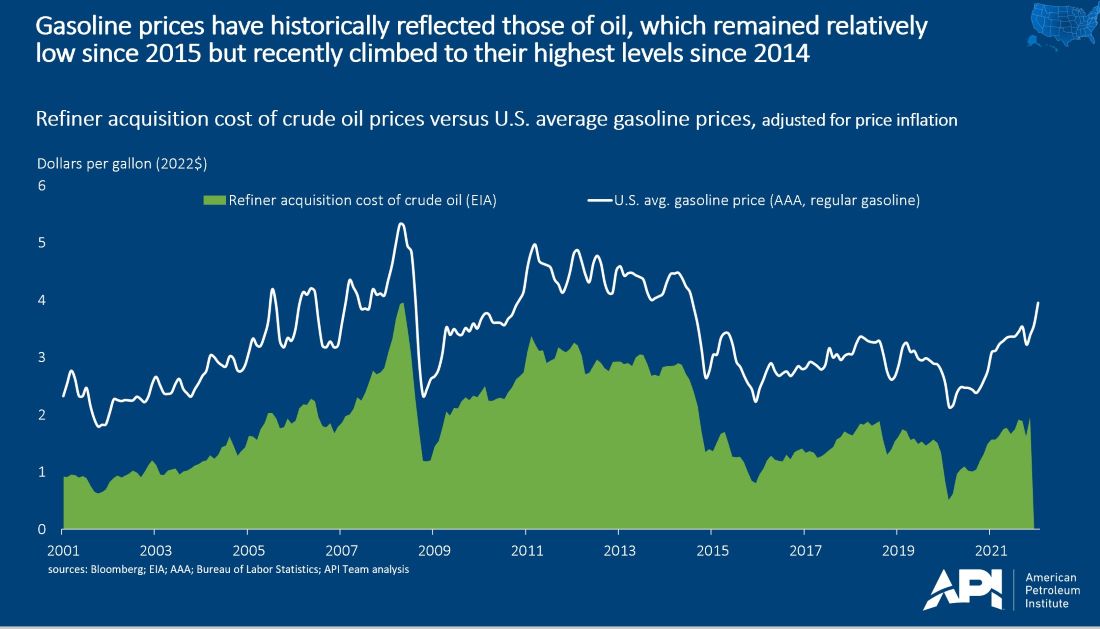

Gasoline prices generally follow the cost of crude oil, which historically is the biggest cost factor in manufacturing gasoline – 56% in January, per the U.S. Energy Information Administration (EIA).

Following the administration’s March 8 announcement, the daily futures prices for delivery next month went up by 3.8% for crude oil and 3.4% for gasoline from the prior day. This was the market’s immediate reaction without details on the proposed ban, what precisely the ban would affect, and how scenarios could evolve.

If Russian crude oil will continue to supply global markets, why have markets reacted so strongly?

Expectations matter, and markets react in real time to uncertainties and information limitations. For all of the geopolitical events that oil markets have weathered in the past few decades, including the actual removal of nearly 5 million barrels per day (mb/d) of Saudi Arabia’s oil production capacity due to the terrorist attack on Abqaiq in September 2019, the price impact of the Russian invasion of Ukraine has already surpassed all of them.

Currently, there are concerns that significant volumes of Russian energy could be impacted – through physical disruptions, by sanctions that prohibit flows, or if Russia decides to wield its energy as a weapon by withholding it from the global market. New sanctions appear they will become a reality, but we need clarity on them. In the meantime, the prospect of sanctions reducing supply not only has increased prices, but it has spurred companies globally to eschew Russian oil that in turn has been offered at a record discount.

What’s the implication of companies leaving Russia?

Importantly, there’s now a corporate exodus from Russia. It’s common in the natural gas and oil industry for large assets and drilling programs to be owned by multiple companies, which in the past has been an efficient way to manage the exploration risk inherent in energy development.

Corporations leaving Russia means that some shares of investment in Russian natural gas and oil production are not likely to occur, and over time this dearth of investment could generally imply lower Russian energy production. In theory, companies could take that capital and invest in production elsewhere. But in reality, this takes time and could delay much-needed new investment across the energy sector.

Apart from Russia, what’s the current state of industry investments in new oil and natural gas production?

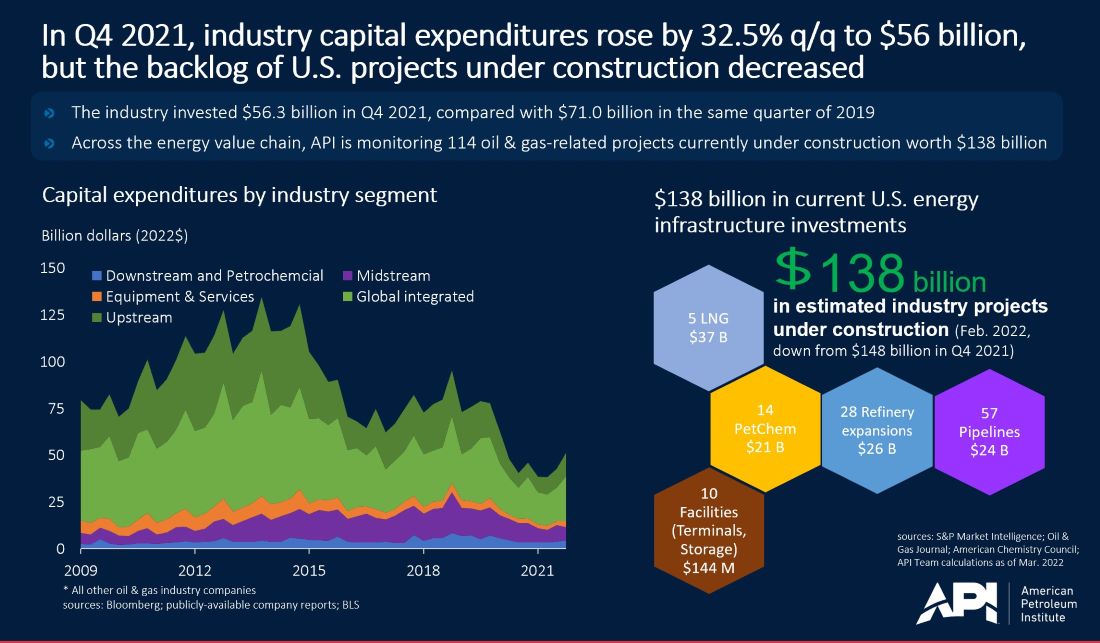

API’s tracking of global industry investment across the value chain showed capital expenditures of $56 billion in Q4 2021, up by one-third from the prior quarter. However, this compared with $71 billion of capital expenditures in the Q4 2019, prior to the pandemic. Similarly, the consensus 2022 capital expenditure estimate for integrated oils and independent exploration and production companies, as reported by Bloomberg, stood at $237 billion for the year, compared with $262.9 billion in 2018 and $264.2 billion in 2019. So, investment has moved substantially in the right direction but lags its 2018-2019 levels.

This could be challenging since demand has rebounded with the economy and risen to its 2019 levels. EIA projects global oil demand to average 100.61 mb/d in 2022, almost identical to demand of 100.67 mb/d in 2019.

What could this suggest for U.S. gasoline supplies and prices?

To be clear, the U.S. has not been importing any finished gasoline from Russia.

In 2021, the U.S. imported 200,000 barrels per day of crude oil and 470,000 barrels per day of petroleum products from Russia, mainly unfinished oils and motor gasoline blending components. The volumes are small in relation to total U.S. refinery production, which processed and consumed nearly 30 times more in 2021, per EIA. Consequently, imposing a ban on Russian energy import could largely be symbolic and not greatly affect prices per se.

A closer look reveals concerns, since trade barriers historically have increased costs. And in a broader context we’re talking about cumulative trade restrictions on Russia, Iran and Venezuela when global oil markets have already been tight. At the very least, shipping and other logistical costs could rise and ultimately impact consumers’ costs. And, as we discussed, expectations could play an important role.

What kinds of shifts in fuel prices in the past have led Americans to change their consumption behavior?

On a given day it’s hard to find anyone who doesn’t know what a gallon of gasoline costs. We all notice it immediately when we pull into a service station. It could be more of a psychological response, but when people see gasoline prices passing round-dollar thresholds – for example to $3, $4 and $5 per gallon – that historically has evoked consumer responses – shifting their driving behavior and vehicle purchases, reducing demand or slowing the growth of demand.

Historical context could matter here. Going back to our 2008 comparisons, energy has been a source of consumer savings since then. According to Bureau of Labor Statistics, consumer expenditures on energy were nearly 25% less in 2020 than they were in 2008, while those on food rose by 14%, education, 22% and healthcare nearly 75%.

We’ve seen price inflation recently increase at its fastest pace since 1982 – up by 7.5% year-on-year (y/y) in January. That’s about twice the rate of price inflation in 2008, and for the average U.S. household today, that translates into expenditures of $383 per month more than one year ago. Roughly 40% of U.S. households don’t have an extra $383 per month, and they face tough trade-offs.

A price of $4.00 per gallon gasoline in 2008 is more like $5.25 per gallon today, once we adjust for price inflation. However, consumer price inflation in mid-2008 ran at about half the rate that it has recently. Consequently, when the prices of virtually everything rise quickly as they have over the past year, consumers could feel pinched at relatively lower fuel prices than they did in 2008.

Is it accurate to say the U.S. became a net exporter of oil under President Trump but returned to net importer status under President Biden?

U.S. economic and energy security should be a bipartisan concern – and one where cogent energy policies could help.

In 2020, the U.S. became a petroleum net exporter of 0.6 mb/d, including crude oil and refined products, for the first time since 1958. Conversely, by API estimates, the U.S. was a petroleum net importer for nine of the past 11 months including 1.6 mb/d in January 2022.

Over the past year, API observed that U.S. oil demand outpaced supply in the wake of the 2020 COVID-19 recession. U.S. oil demand returned to 21.6 mb/d barrels per day in January 2022 – fully 1.0 mb/d higher than it was in January 2019 (pre-COVID). Yet, U.S. crude oil production of 11.6 mb/d remained more than 1.3 mb/d below its highest levels in the fourth quarter of 2019.

U.S. crude oil production decreased due to a combination of factors – work force shortages, supply chain issues, financial and energy policies – and has been unable to increase in response to higher prices, as it has done in the past. Seemingly long-term policies can affect investment today. Restrictive energy polices -- including undermining pipeline infrastructure, an indefinite moratorium on leasing on federal lands, proposed higher taxes and a clean energy plan to eliminate natural gas in power generation – have not helped to stimulate investment, drilling and production needed to meet demand.

How quickly could U.S. oil producers scale up production to put downward pressure on domestic gasoline costs? What could the federal government do to promote that production?

Oil prices and consequently motor fuel costs are established in global markets, which have recently been grappling with uncertainties about whether the Russia-Ukraine war could impede energy flows. Historically, U.S. shale oil production has been able to ramp up within a matter of months, but as discussed earlier, the compound effects of work force, supply chain, financial and energy policy headwinds have slowed that responsiveness.

It begins with access to resources, advancing infrastructure and enabling (rather than deterring) the industry’s financing. Importantly, financial markets have become less hospitable to the natural gas and oil industry in part because of the Biden administration’s positions, policies and signals. Those who have capital may be reluctant to invest in long-lived energy assets in such a climate, and a relatively fixed pool of cash flows that could be re-invested by industry have been increasingly spread thin. API President and CEO Mike Sommers told the Wall Street Journal:

“I think that both the industry, and I think Wall Street needs the signal that the White House wants this industry to be producing more at a time of national crisis. And I think they need to stop the rhetoric that, you know, this industry is seeking to capitalize on a tragic moment in U.S. history and world history.”

Here are concrete actions the administration could take right now to support American production:

1. Conduct federal lease sales

Nearly 25% of the nation’s crude oil volumes come from federal lands and waters. The administration should mitigate whatever shortfall its restrictive policies already have baked into future production by fulfilling, as soon as possible, its statutory responsibility to hold lease sales.

The U.S. Interior Department recently announced that the one onshore lease sale that was planned now is indefinitely on hold following a recent court decision barring the administration from using its interim estimates for the social cost of greenhouse gas emissions. This particular cost analysis, however, is not required for lease sales, so the administration can and should proceed with previously used cost estimates.

2. Complete a new five-year program for federal offshore leasing

Interior should expeditiously complete the next five-year leasing program to replace the current one that expires this summer. The program serves as the blueprint for future federal offshore lease sales, communicating to American producers where and when offshore tracts will be up for auction. This is critical for planning, financing and investment.

The fact it has been more than a year since the last successful offshore lease sale is unprecedented. It’s alarming that we’re on a path for at least a second year without offshore leasing. The administration’s protracted delay in issuing the next iteration of the leasing program is detrimental to key offshore energy development.

3. Support energy infrastructure

The administration should work with all relevant agencies to ensure that infrastructure permitting processes are designed and implemented in a manner that ensures consistency, transparency, and timeliness. (As another benefit to the administration is that this would aid renewable energy infrastructure as well.)

4. Reopen access in Alaska

The administration should reinstate the leases it suspended in Alaska’s Arctic National Wildlife Refuge and the permit development it approved in the National Petroleum Reserve. These were permitted with stringent environmental standards and could prove to be a significant source of domestic production over time.

What’s happened with recent natural gas price volatility?

Natural gas spot prices at Henry Hub returned to nearly $5.00 per million Btu as of March 7. Their levels matter to U.S. industry in general and especially in the operations costs in refining and petrochemicals.

By comparison, global natural gas markets have been in disarray with unprecedentedly high prices exceeding $50 per mmBtu in Asia Pacific $68 per mmBtu in continental Europe as of March 7.

Two things about natural gas prices are notable: For one thing, unlike oil, they remain regional rather than global. Thanks to the U.S. energy revolution having made natural gas production prolific in excess of domestic needs, prices at home remain lower than global ones. Europe and parts of Asia Pacific are major consuming regions that are paying far higher prices as a result of their demand outpacing supply, plus import reliance. In China’s case, demand rose more than 20% y/y.

In Europe, the problem has been declining continental production combined with lower Russian supplies, resulting in critically low inventories – even as renewables underperformed in the power sector serving the United Kingdom and continental Europe.

Consequently, they are competing with countries in Asia Pacific for available LNG cargoes. And they have had no near-term solution in sight, other than getting past this winter. That’s the other thing about natural gas prices – they’ve historically remained highly seasonal since winter heating is the largest application.

About The Author

Dr. R. Dean Foreman is API’s chief economist and an expert in the economics and markets for oil, natural gas and power with more than two decades of industry experience including ExxonMobil, Talisman Energy, Sasol, and Saudi Aramco in forecasting & market analysis, corporate strategic planning, and finance/risk management. He is known for knowledge of energy markets, applying advanced analytics to assess risk in these markets, and clearly and effectively communicating with management, policy makers and the media.