Earnings in Perspective

Mark Green

Posted May 3, 2022

As quarterly earnings reports come out from America’s natural gas and oil companies, below are four things to know about earnings and their context, with the help of a series of charts.

1. It’s a Business

Understanding the industry’s earnings starts with recognizing that U.S. natural gas and oil companies find and produce oil and gas for fuels, feedstocks and a multitude of products defining modern life – as a business.

They are not government or quasi-government entities like the state-owned enterprises that control the vast majority of the world’s oil and natural gas reserves (more below). Most are publicly owned by shareholders and operate like other businesses under American capitalism – providing goods and services that customers buy and businesses need.

They pay taxes on income to government, earn value for their investors and plow funds into research, technologies and new projects to meet ever-growing energy demand. When a company is in the black, it is generating revenues for governments, creating and supporting jobs, and helping drive economic growth.

Some confusion may arise over the role of American natural gas and oil companies from the fact they often develop oil and natural gas in federal and state areas – public reserves owned by the American people. Of course, individual Americans do not produce or refine oil and natural gas themselves; companies lease public acreages onshore and offshore and then pay royalties, rents and other fees as energy is produced. On private lands they contract with private mineral rights owners to develop energy there.

2. Oil and Natural Gas are Critical to Energy Security

Since energy touches virtually every aspect of modern life, it’s critically important for the U.S. to have secure sources of natural gas and oil and, under our economic system, a robust energy industry to develop them. The charts below help make that point.

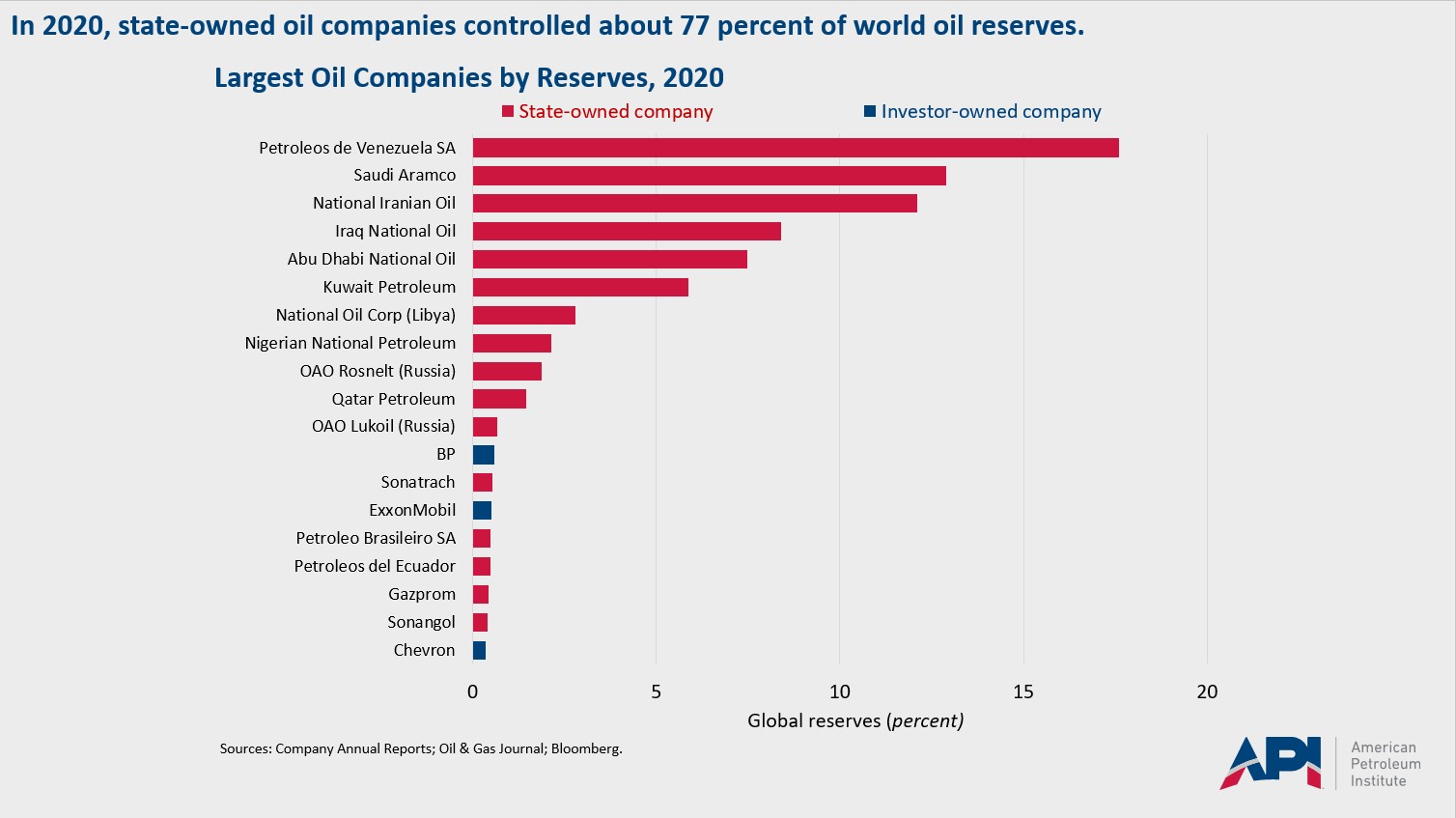

Sixteen of the top 19 oil companies in 2020, ranked by percent control of global reserves, were state-owned companies, including Nos. 1-11. Together, state-owned companies, operating at the behest of their respective governments, controlled more than three-quarters of the world’s crude oil reserves.

That control, some nations’ history of using energy as a weapon and the fact that not all of the countries in the ranking above are U.S. friends, make the case: A strong American oil sector is essential for our country’s energy and overall security.

American oil production means the U.S. is less reliant on foreign suppliers, and to do this, U.S. companies must have access to resources and the ability to invest in new exploration and development. American voters get the point. Recent polling showed 90% support the U.S. developing its own domestic energy rather than relying on other regions of the world. Mike Sommers, API president and CEO:

“This nation has accessible oil and natural gas reserves to match any stretch of earth ruled by any regime or cartel. It was our goal for decades to break free of dependence on foreign suppliers. We talked about energy security forever, and then we finally achieved it. We worked hard to put America in that position of strength and greater energy independence. We would be foolish to ever give it up.”

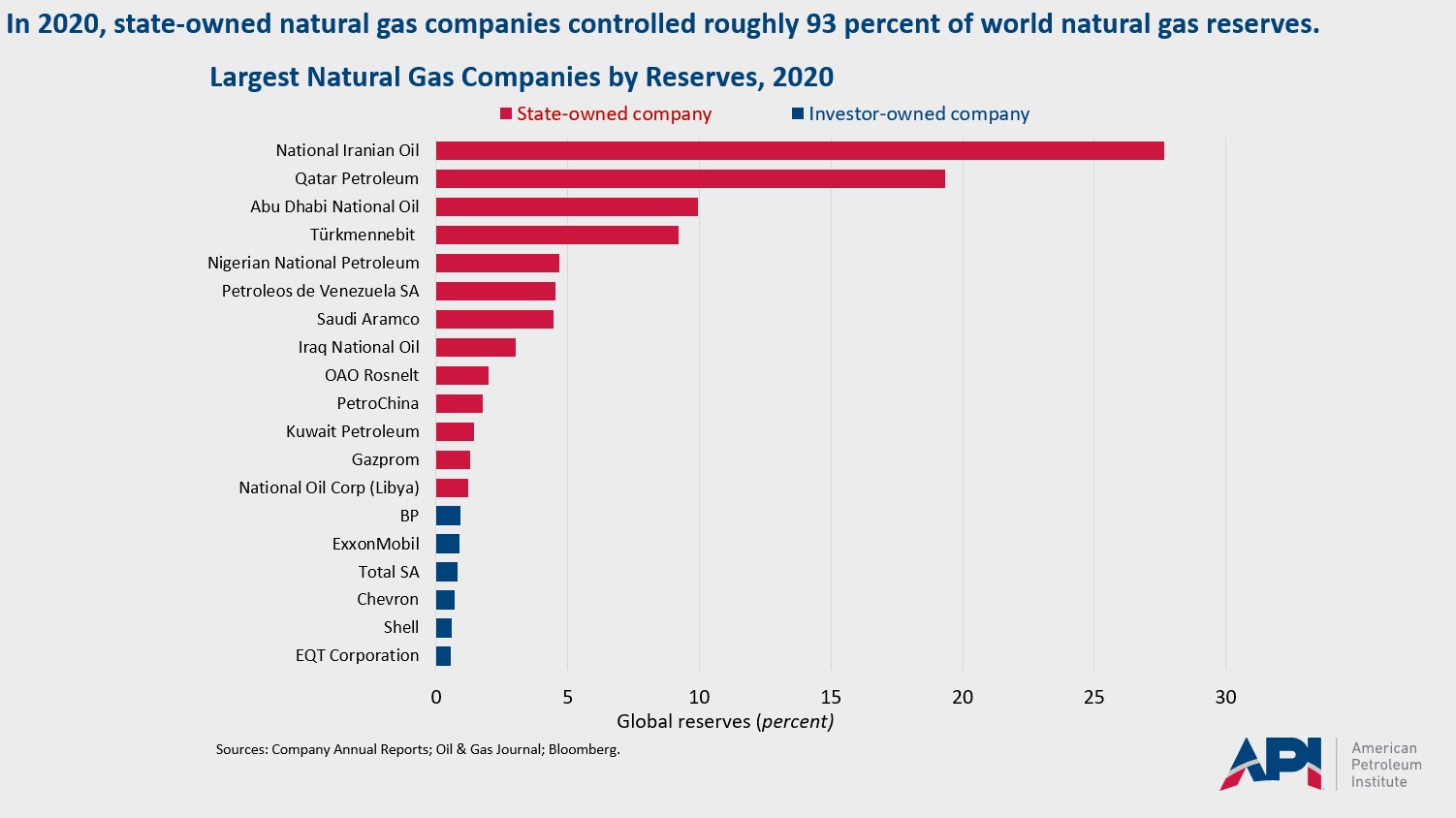

The picture is even more dramatic for natural gas. The chart below shows that state-owned companies control about 93% of the world’s natural gas reserves:

Thirteen of the top 19 natural gas companies in 2020, ranked by percent control of global reserves, were state-owned. Again, it’s critically important for American natural gas production to be robust to meet demand here at home and – as underscored by Russia’s war against Ukraine – to help supply allies overseas.

3. Millions Own “Big Oil”

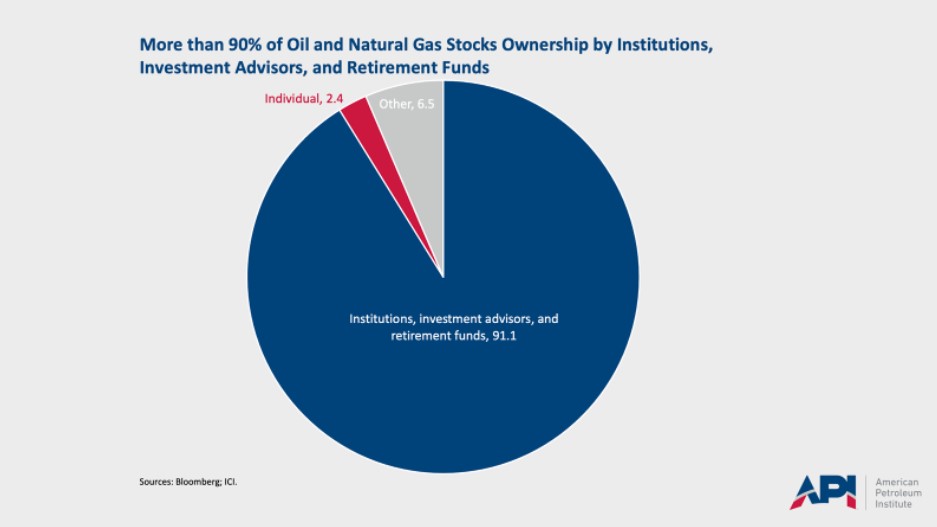

As earnings reports are released, remember – as the chart below shows and starkly contrasting with the previous two charts above – more than 90% of the stocks of natural gas and oil companies are owned by institutions, investment advisors and retirement funds, including those of millions of Americans invested in 401Ks as well as private and public pension funds that typically are accessible by groups including teachers and firefighters.

Financial institutions and investment advisors, including paid asset managers, also have significant oil and natural gas stock holdings. These include endowments, governments, hedge fund managers, banks and many others.

Just 2.4% of natural gas and oil stocks are owned directly by individuals. Contrary to some claims heard during earnings season, natural gas and oil company corporate officers do not own large amounts of oil and natural gas stock.

4. Industry’s Earnings are Similar to Other S&P 500 sectors

This year’s first-quarter earnings are generating attention largely because the price of crude oil was significantly higher the first three months of the year, as growth in demand for fuels and other petroleum products outpaced growth in supply. Some Democrats have called for a federal investigation into higher gasoline prices, but prices at the pump simply reflect higher costs for crude oil. Frank Macchiarola, API senior vice president for Policy, Economics and Regulatory Affairs:

“This is an industry of price takers, not price makers, and repeated in-depth investigations by the FTC (Federal Trade Commission) have shown that changes in gasoline prices are based on market factors and not due to illegal behavior.”

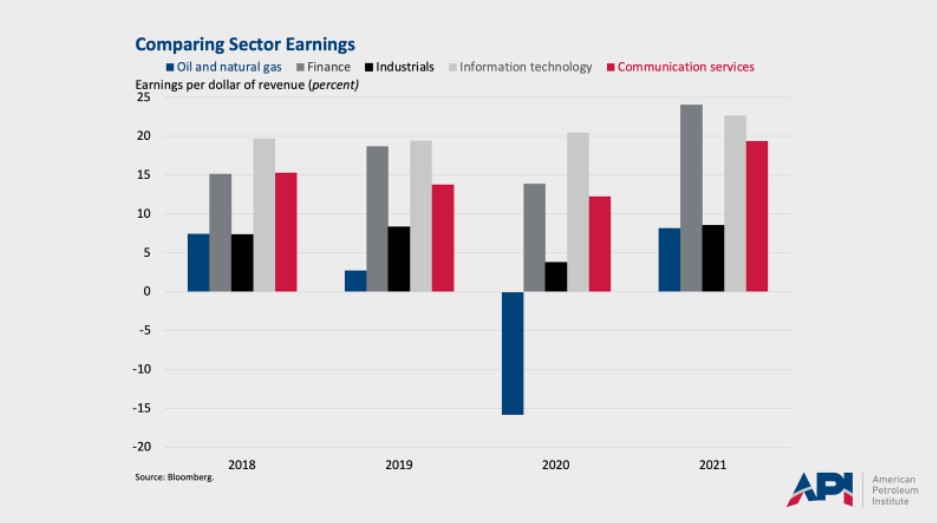

Earnings should be viewed in a larger context than just one quarter. In the first chart below, natural gas and oil company earnings per dollar of revenue (red bars) are in line with or below those of the S&P 500 as a whole from 2018 through 2021:

Notable above is the impact of the 2020 economic slowdown associated with efforts to deal with the pandemic, stretching from late 2019 through the first quarter of 2021.

Relative to other S&P 500 sectors, natural gas and oil earnings can fluctuate more – because of lags in the sector’s ability to respond to rapid changes in demand. In the chart below, oil and gas earnings (expressed as earnings divided by overall revenue) were not out of line with those of other S&P 500 sectors:

For reference, finance includes banking and consumer finance; industrials include capital goods and transportation; information technology includes IT services and electronics; and communications services includes providers such as AT&T.

Bottom line: earnings reflect the health of a sector that’s vital to economic growth and the country’s security. The answer to higher costs for fuel and other commodities isn’t to denigrate producers. Rather, it’s to recognize that America is strongly positioned to increase control over energy security by developing American natural gas and oil. More from Sommers:

“[M]ost everyone knows that the world needs oil and natural gas in a big way and will for decades or more to come. The only question is where that oil and gas is going to come from. Facing energy reality through that prism, you quickly arrive at a moment of clarity about the irreplaceable assets of American oil and natural gas. We see friendly nations left vulnerable, and we never want to be in that position ourselves. … [A]s complex as the economic picture might seem, the simple precondition for lower energy prices is greater supply. As much as ever, we need to think hard about that economic truth and our energy future. And we must act. That means recognizing energy from natural gas and oil as the critical strategic asset it is to America.”

About The Author

Mark Green joined API after a career in newspaper journalism, including 16 years as national editorial writer for The Oklahoman in the paper’s Washington bureau. Previously, Mark was a reporter, copy editor and sports editor at an assortment of newspapers. He earned his journalism degree from the University of Oklahoma and master’s in journalism and public affairs from American University. He and his wife Pamela have two grown children and six grandchildren.