The Picture for U.S. Onshore Oil and Natural Gas Leasing: Not Pretty

Mark Green

Posted May 4, 2023

Let’s update the ongoing situation with onshore federal leasing – or lack of it – noted last fall.

First, know that production in federally controlled onshore areas accounted for about 10% of all U.S. oil production in 2021 and about 9% of total natural gas production. Federal onshore leasing is important, and we don’t believe it’s optional.

Federal law says lease sales “shall be held for each State where eligible lands are available at least quarterly …” But the Biden administration has seen things differently, holding just one round of quarterly sales since Q1 2021:

Under pressure from Congress this week, Interior Secretary Deb Haaland said 12 onshore lease sales would be held this year and promised to “follow the law” on leasing without explicitly committing to quarterly sales. The concern is that a lapse in onshore leasing like the one that has developed the past couple of years could mean lost production a few years down the road, impacting America’s energy security.

Here’s what we know about the onshore leasing picture, and it’s not a pretty one:

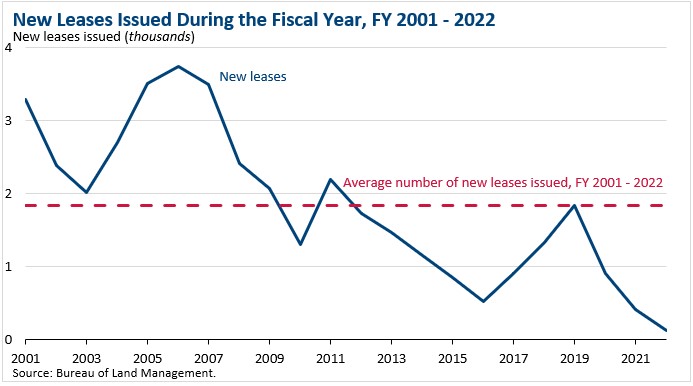

New Federal Onshore Leasing is Way Down Since Fiscal Year 2021

According to Bureau of Land Management (BLM) data, the number of new federal onshore leases issued in fiscal year (FY) 2022 was down 71% year-on-year compared to FY 2021. Compared to FY 2020 the number of new leases issued in FY 2022 declined 87%:

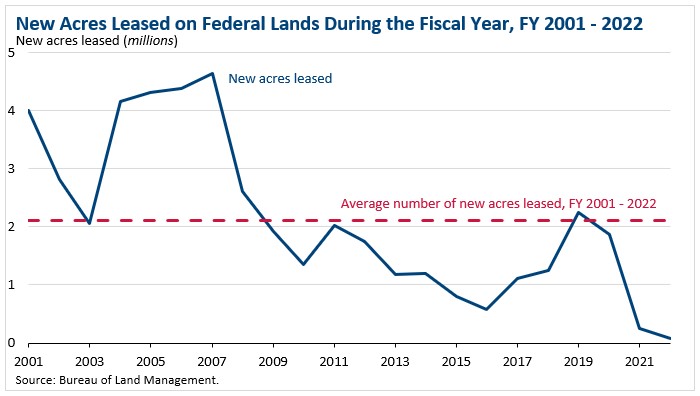

This decrease is also seen in new acres leased – down 70% in FY 2022 vs. FY 2021 and down 96% compared to FY 2020:

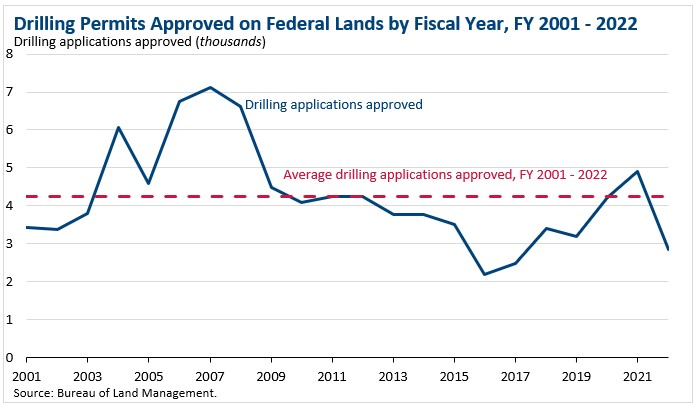

The Federal Approval Process Has Slowed Significantly

Due, in part, to the administration’s posture on onshore oil and natural gas leasing there also has been a decline in the number of approved applications to drill, which fell 42% in FY 2022 compared to FY 2021:

BLM’s approval rate of processed onshore applications for permit to drill (APDs) in FY 2022 was 88% – 10 percentage points lower than the FY 2021 APD approval rate (98%).

These are not good numbers and not a good trajectory for federal onshore production, which, again, is critically important for America’s energy security.

American Oil and Natural Gas is Doing Its Part

Energy companies have ramped up activities – in our opinion, mostly despite policies from Washington:

- In FY 2022, 2,063 well bores were started on federal lands, a 27% increase over FY 2021. Compared to FY 2020, well bore starts were 39% higher in FY 2022.

- There were about 90,000 producible and service well bores on federal lands in FY 2022.

- Of federal lands with leases in effect in FY 2022, 52% of acres leased were producing – the highest that number has been in more than 22 years. Credit producers for the technologies and innovations that have made that a reality. Onshore, 69% of federal leases were producing in FY 2022, a figure that has increased consistently since 2008.

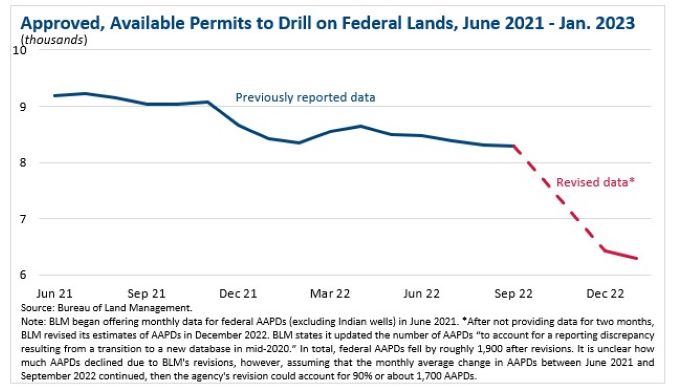

Another point on onshore production. The graph below shows BLM data for approved and available permits to drill (AAPDs):

You may recall this was the administration’s main talking point when it was trying to deflect attention from policies that impacted American oil and natural gas production – impacts seen in the negative trend lines noted previously. (Note as well that current production volume is largely because of decisions and investments energy companies made before the Biden administration took office.)

As discussed in this post debunking the administration’s claim, the graph shows the disparity between what BLM reported last September on AAPDs and the revision it produced in December. Still waiting for the White House to acknowledge this – as well as the concerning picture for U.S. onshore federal leasing going forward. Holly Hopkins, API vice president of Upstream Policy:

“For months we’ve been calling on the Department of the Interior to fulfill its statutory obligation to hold quarterly oil and natural gas lease sales for federal lands. Given that federal onshore production has accounted for about 10% of total U.S. oil production and 9% of natural gas, the lack of new leasing opportunities could have serious impacts on production that’s critical to American energy security. The administration should follow the law and hold quarterly lease sales.”

About The Author

Mark Green joined API after a career in newspaper journalism, including 16 years as national editorial writer for The Oklahoman in the paper’s Washington bureau. Previously, Mark was a reporter, copy editor and sports editor at an assortment of newspapers. He earned his journalism degree from the University of Oklahoma and master’s in journalism and public affairs from American University. He and his wife Pamela have two grown children and six grandchildren.