Demand for U.S. LNG Shows Folly of Permitting Pause

Mark Green

Posted December 4, 2024

Global demand for U.S. liquefied natural gas (LNG) remains strong – which again should give pause to the Biden administration’s decision to halt in permitting for new and pending LNG export projects. Let’s take a look around the world.

- There’s demand from Asia. A new Wood MacKenzie study forecasts that Asia’s LNG demand will nearly double by 2050. Notably, the study warns that without significant LNG supply from America, more coal would be used, driving carbon dioxide (CO2) emissions higher.

- There’s demand from Europe. According to Oilprice.com, natural gas prices there are at their highest levels in a year – amid concerns about supply from Russia and high demand for heating and power generation as temperatures turn colder.

- Reuters and others report that the latest data from financial firm LSEG shows LNG export facilities were expected to draw 14.6 billion cubic feet per day (bcf/d) last week, the highest for the year and near the all-time record of 14.7 bcf/d set last December.

- These data points are consistent with the International Energy Agency’s (IEA) report this fall that global natural gas demand is rapidly increasing and probably will reach all-time highs this year and next. The same report pointed to the U.S. LNG pause as a factor in what IEA called “fragile” global LNG supply.

All of the above strengthen the argument for ending Washington’s LNG permitting pause – misguided and without merit – which some have characterized as “political and partisan.”

So, with the U.S. Energy Department (DOE) reportedly poised to release an LNG export study that could be used to justify the nearly year-long permitting pause, let’s review the administration’s stated reasons for the policy.

Administration officials said they were concerned that U.S. LNG exports:

- Negatively affected domestic natural gas prices (they didn’t)

- Carried climate risks (LNG is a key climate solution)

- Are not needed globally (see above)

Details:

LNG exports have not negatively impacted the U.S. energy market

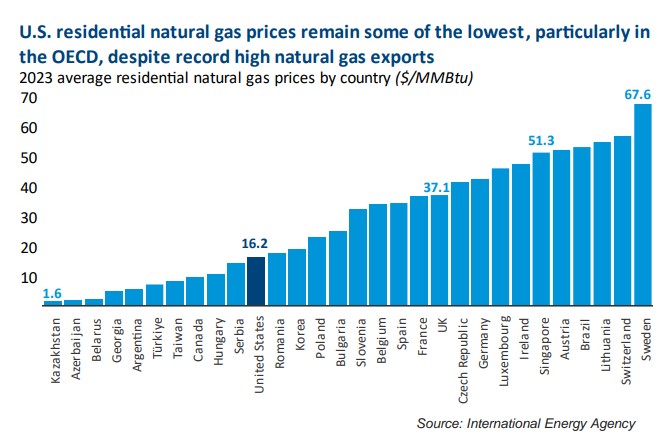

- Amid record U.S. LNG exports, Americans have benefited from some of the lowest residential natural gas prices in the world.

- Since LNG exports began in 2016, Henry Hub natural gas prices have averaged 37% lower than the preceding decade.

- Growth in natural gas production has outpaced LNG export growth nearly three-fold since the birth of the U.S. LNG export industry.

- In fact, the U.S. LNG industry drives significant domestic economic growth, contributing $44 billion in economic activity in 2023 and supporting more than 222,000 U.S. jobs.

U.S. LNG is a climate solution

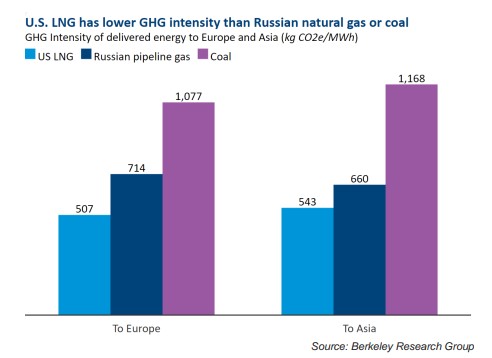

- American LNG that is exported to allies is an opportunity for those countries to reduce their CO2 emissions – as the U.S. has done. America has led the world in CO2 emissions reductions since 2005, mostly because of using natural gas instead of coal to fuel electricity generation.

- Because U.S. LNG has a far lower emissions profile than the fuels it would likely displace, there is great potential for these exports to drive global emissions reductions.

- Meanwhile, on the natural gas production side, methane emissions from U.S. natural gas and oil production have fallen more than 40% since 2015 – even as production increased more than 50%.

U.S. LNG is in demand globally

- The U.S. Energy Information Administration (EIA) projects global natural gas demand will increase 29% by 2050, pushed by demand from emerging economies and as coal-heavy regions seek to decarbonize. Again, see the Reuters article and Wood Mackenzie study on LNG demand.

- The amount of LNG export capacity sidelined by the Biden administration’s LNG permitting pause equals Japan’s annual natural gas consumption and represents more than $50 billion in direct investment.

- U.S. LNG remains key to our allies’ energy security (which strengthens our own security). After Russia’s invasion of Ukraine, the U.S. was able to replace more than 85% of the natural gas Europe lost that winter. Recently, European Union President Ursula von der Leyen suggested the EU may look to replace natural gas supplies the bloc still receives from Russia with U.S. LNG.

Source: EIA

The LNG permitting pause was misguided policy and should be lifted on Day 1 of the new administration. The actual U.S. LNG picture is worsened by the fact that in the 11 months before the administration imposed its permitting pause last January, DOE did not issue any permits for projects involving non-Free Trade Agreement nations. It’s possible that by early 2025, DOE will have gone two full years without issuing a non-FTA permit.

American natural gas helps allies, benefits U.S. trade and has helped grow the domestic economy – even as American families enjoyed some of the lowest natural gas prices in the world. U.S. LNG can help other nations lower their emissions and advance climate goals.

There’s no good reason to continue limiting America’s opportunity to be the world’s LNG supplier of choice.

About The Author

Mark Green joined API after a career in newspaper journalism, including 16 years as national editorial writer for The Oklahoman in the paper’s Washington bureau. Previously, Mark was a reporter, copy editor and sports editor at an assortment of newspapers. He earned his journalism degree from the University of Oklahoma and master’s in journalism and public affairs from American University. He and his wife Pamela have two grown children and six grandchildren.