How DOE’s LNG Exports Study Could Clash with Real-World Data

Dustin Meyer

Posted December 16, 2024

When the U.S. Energy Department (DOE) presents its long-awaited study of American liquefied natural gas (LNG) exports, there’s a good chance the arguments it makes – supporting the current administration’s year-long LNG exports permitting pause – will collide with a wall of data from independent analyses to the contrary.

When the pause was announced nearly a year ago, the administration claimed they needed new economic and environmental data to authorize LNG exports. Now, with a new administration coming to town, DOE’s study looks more like a rear-guard action to justify a decision – which many believed to be politically motivated – that was misguided, damaged American energy leadership and impacted the security of U.S. allies.

It’s arguable that DOE could have saved time and taxpayer dollars by simply looking at the economic data that already was available.

We’ve shown that the administration’s concerns about LNG demand and the environment are without merit. So, let’s take another look at domestic energy prices. Here is what we know:

LNG Exports Have Not Hurt American Consumers …

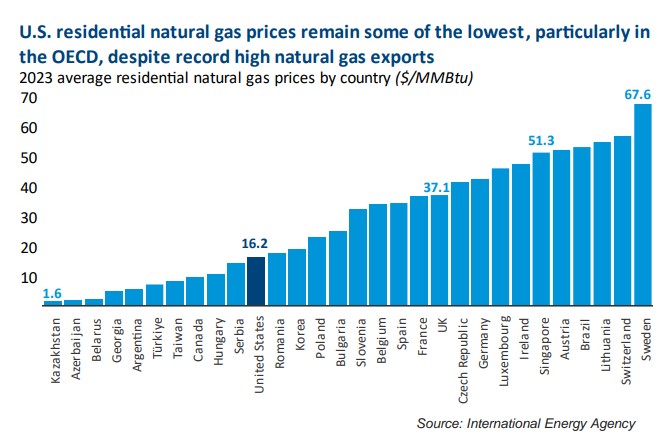

U.S. natural gas prices are among the lowest in the world. That’s from the International Energy Agency (see Page 52), not API.

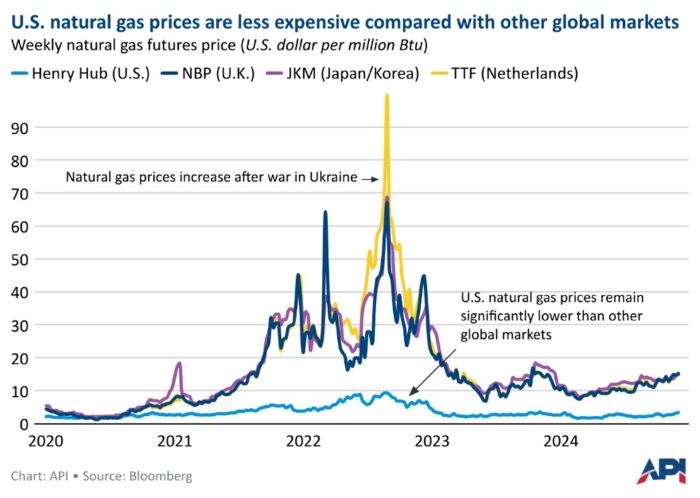

U.S. natural gas futures prices are significantly lower than those in the United Kingdom, Japan and the Netherlands.

This is as U.S. LNG exports reached record highs in 2023, coinciding with an average price of $2.53 per million Btu (MMBtu) at Henry Hub – well below the 2010-2015 average of $3.64 MMBtu (pre-LNG exports) and more than 60% below 2022 price levels, according to the U.S. Energy Information Administration (EIA). In fact, EIA reports that on Nov. 8 and Nov. 11, the daily Henry Hub price fell to $1.21 MMBtu, an all-time low in inflation-adjusted dollars.

When adjusted for inflation, U.S. residential natural gas prices from 2016-2023 show very little variation from history. Looked at another way, U.S. LNG exports went from zero in 2015 to about 200 billion cubic feet (bcf) in 2019, yet the residential natural gas price went down.

… Because U.S. Natural Gas Workers Have Increased Supply

Domestic natural gas production has increased 43% since 2015, meeting domestic demand and demand for LNG exports.

This should not surprise anyone at DOE. A 2018 DOE study concluded:

“Available natural gas resources have the largest impact on natural gas prices. Therefore, U.S. natural gas prices are far more dependent on available resources and technologies to extract available resources than on U.S. policies surrounding LNG exports.”

Ben Cahill, an expert on oil markets, geopolitics, and the oil and natural gas industry, wrote earlier this year:

“In the past five years, LNG exports have not driven up U.S. gas prices as some feared. Natural gas output has only continued growing in the Marcellus, the Permian Basin, and elsewhere. In November 2023, U.S. dry natural gas production reached an all-time high. So far, abundant natural gas supplies have satisfied domestic demand, supported LNG exports, and enabled a sharp increase in pipeline gas exports to Mexico.”

Higher Electricity Prices? Look to Infrastructure, Regulation

If, as expected, DOE’s new study blames LNG exports for higher electricity prices, look deeper, to infrastructure constraints and heavy-handed regulation.

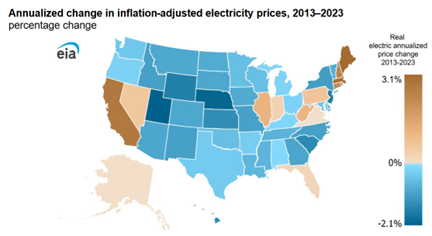

First, EIA reports electricity price increases in most states fell within a few percentage points of the U.S. inflation rate. This indicates broader inflationary pressure is largely responsible for electricity price increases, not LNG exports.

Meanwhile, infrastructure issues and regulation have played major roles in areas that have seen big increases in electricity prices.

- In New England, which has some of the highest electricity prices in the U.S., EIA says they were due in part to “higher transportation costs for fuels due to competition for limited pipeline infrastructure into the region.” That’s a significant infrastructure problem – one with a relatively simple solution: Build more pipeline capacity out of neighboring Pennsylvania, one of the nation’s leading natural gas producers.

- In California, which also has some of the highest electricity prices in the country, EIA pointed to costs associated with grid modernization and incentives for renewables, as well as increased operational and maintenance costs from wildfires and other natural disasters. Of course, California mandates that a high percentage of the state’s energy must come from renewable sources.

EIA goes on (emphasis ours):

“Over the past decade, the largest annualized real electricity price declines occurred in Utah (2.1%) and Nebraska (2.0%). Access to diverse and abundant local energy resources, including coal, natural gas, wind, and solar, helped keep price increases low despite growing demand for electricity. These states also benefit from well-developed transmission networks, excess capacity that can serve growing demand without the need for significant new investment, and relatively low population densities that limit the need for distribution upgrades.”

America needs more energy infrastructure – and permitting reform so that projects don’t languish in the federal review system for years on end. (On permitting reform, check out item #4 in API’s Five-Point Policy Roadmap, calling for smart, comprehensive action – which eight in 10 Americans support.)

A NERA Economic Consulting study found the same, that a “lack of new pipeline infrastructure is a material impediment” to industry bringing natural gas supply to where it is needed. Further, the study “demonstrates that natural gas price impacts from increasing accessibility of supply would actually reduce natural gas prices, even with higher levels of U.S. LNG exports.”

The bottom line: There’s no good reason for Washington to continue restricting America’s capacity to export LNG. The opposite is true: There’s much in favor of LNG exports, including support for allies’ energy security, America’s global energy leadership, and domestic jobs and economic opportunity.

API President and CEO Mike Sommers underscores the broader implications:

“Liquefied natural gas is a gamechanger for U.S. energy leadership. But the administration's efforts to block new LNG facilities create a void global competitors will fill. It's time to fully restore LNG export permits to support U.S. jobs and allies overseas.”

About The Author

Dustin Meyer is Senior Vice President of Policy, Economics and Regulatory Affairs, leading API’s public policy departments and overseeing the organization’s economics, research, and regulatory functions.

He previously served as API’s Vice President of Natural Gas Markets, dealing with issues related to domestic and global natural gas markets, as well as natural gas technology and innovation including renewable natural gas, differentiated/responsibly sourced natural gas, hydrogen and the use of CCUS in the power sector.

Prior to joining API, Meyer led analytics, forecasting and consulting services on global LNG and renewable energy markets for Energy Ventures Analysis. He also held analysis positions at PFC Energy and then IHS Energy on upstream investment in North American oil and natural gas, including liquefaction projects in the U.S. and Canada. Meyer also worked at ICF International on the transportation policy team and for various NGOs.

He earned his undergraduate degree at Princeton University and received his Master’s focused on Energy Policy & Economics from Yale University.