Scalise, Brady Highlight Critical Role of Tax Policy for U.S. Energy in 2025

Mark Green

Posted December 17, 2024

Tax policy will be an important issue in 2025, which is why advancing sensible policies is integral to API’s Five-Point Policy Roadmap – an action plan for the new Congress and incoming Trump administration to secure American energy leadership and help reduce inflation.

The roadmap cites the need for “sensible” tax policies because they affect where financial capital goes. America’s tax policy toward energy development must be competitive with other countries, because capital flows where it is welcome.

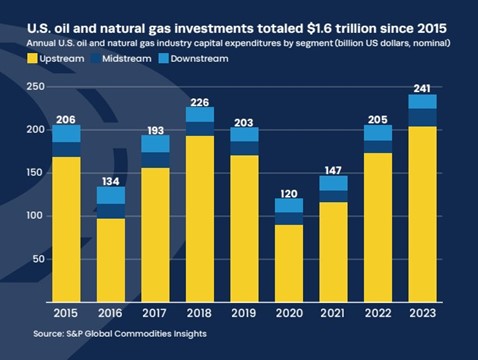

This is critically important considering the U.S. oil and natural gas industry supports nearly 11 million jobs and is responsible for billions in domestic investment.

Specifically, the new administration and Congress should:

- Retain the 21% corporate tax rate

- Maintain and extend tax provisions for domestic infrastructure investment

- Preserve key international tax provisions to protect oil and natural gas companies making overseas investments from duplicative and punitive double taxation.

During an API/Business Roundtable tax discussion, two experienced legislators – U.S. House Majority Leader Steve Scalise and former U.S. Rep. Kevin Brady, who chaired both the Ways and Means Committee and Joint Economic Committee – talked about prospects for tax policy action in Congress and specifically, extension of the 2017 Tax Cuts and Jobs Act (TCJA) that contained important energy-related provisions.

A factor will be the makeup of the new Congress. Scalise pointed out that 60% of House Republicans were not in elected or in Washington when the TCJA passed Congress. A lot of the staff is new as well, which means there is a learning curve, for example, on reconciliation, which allows expedited consideration of certain tax, spending, and debt-limit legislation. “It’s not as easy as it looks,” Brady said of reconciliation.

Scalise said the goal on TCJA will be to maintain existing tax law. Without renewal, America will face what amounts to a multi-trillion-dollar tax hike, he said.

Both said many companies across the economy took the savings gleaned from TCJA to build new factories, create new jobs and give end-of-year bonuses to employees.

Energy policy, strengthening America’s economy and tax policy (as well as border security) will be part of the Republican reconciliation legislation, Scalise said.

Welcome news, indeed. Helping ensure tax policy works with America’s energy producers, not against them, is important to U.S. energy leadership. From API’s roadmap:

“Industry investment rests on sound, predictable tax policy. With many key tax provisions expiring at the end of next year, it is critical they be extended to ensure the next chapter of our energy future is once again written here in America.”

About The Author

Mark Green joined API after a career in newspaper journalism, including 16 years as national editorial writer for The Oklahoman in the paper’s Washington bureau. Previously, Mark was a reporter, copy editor and sports editor at an assortment of newspapers. He earned his journalism degree from the University of Oklahoma and master’s in journalism and public affairs from American University. He and his wife Pamela have two grown children and six grandchildren.